The coming foreign investment flood

Stocks, bonds set to sizzle following inclusion in a global index and easing of controls on two-way capital flows

For China's capital markets, a massive, potentially irreversible game-changer is on the horizon.

The imminent change is expected to open the floodgates for unprecedented levels of foreign investment.

"China is now too important a market to ignore because investors can find the kind of growth opportunities here that are rarely available in other parts of the world," said Jeff Li, a London-based global equity fund manager at EFG Asset Management.

The scenario Li foresees is a far cry from the recent past.

For long, global investors' abysmally low exposure to China's capital markets has been disproportionate to the country's 16 percent share of the world gross domestic product ($87.5 trillion in 2017, as per IMF data) and the 106 trillion yuan ($16.5 trillion) valuation of its equity and bond markets.

For years, foreign ownership of China's A shares, or renminbi-denominated equities traded on the stock exchanges in the Chinese mainland, has been static around 2 percent or less.

This, despite the fact that China's stock market, whose capitalization is over $8.5 trillion, is the world's second-largest.

All these years, foreign participation was also minimal in the Chinese bond market, the world's third-largest valued at $8 trillion as of April.

Unlike economic sectors like manufacturing where foreign investment is pronounced, China's capital markets have been funded almost entirely by domestic money.

That, however, is set to change. And the change will likely be big and rapid.

Chinese stocks and bonds are poised to be included in major global indices. And the Chinese regulators intend to further open up the markets by loosening controls on two-way capital flows.

After three failed attempts, the A shares will be finally included in the MSCI Emerging Markets Index on Friday. The index, tracked by more than $1.9 trillion assets at the end of 2017, is one of the benchmark indices followed by global fund managers who wish to have an exposure to equities of emerging markets.

Initially, 234 large-cap A-share stocks will be added to the MSCI EM Index. The inclusion will be further expanded in August, making China's A shares account for about 0.81 percent of the overall index.

Even with the small initial representation, the A shares' inclusion is a milestone event that heralds further integration of China into global financial markets, said Alain Bokobza, head of global asset allocation and equity strategy at French bank Societe Generale.

If observers think there is nothing in the MSCI move to be excited about given the A shares' initial small weighting, they could be missing the real point, he said. While the index's revamp itself may turn out to be "a storm in a teacup", Chinese shares' tradability and liquidity are growing fast. This offers a chance for money managers to get bigger exposure to the Chinese economy, Bokobza said.

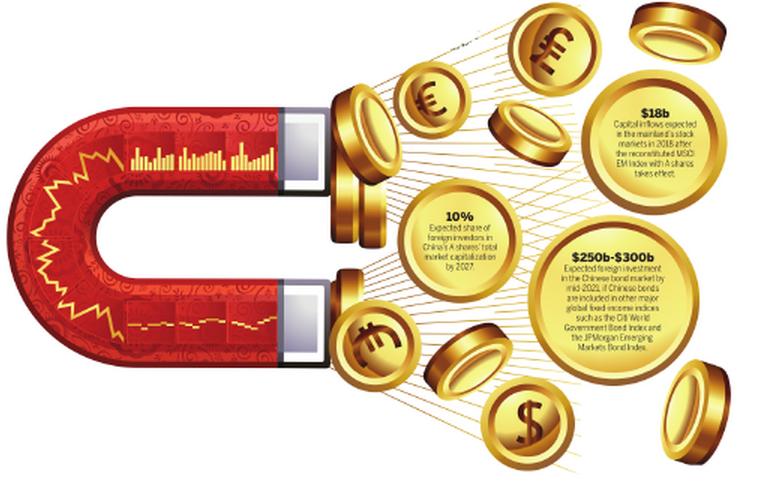

The inclusion is expected to immediately trigger an inflow of about $18 billion into the Chinese mainland equity market. Some estimated the inflows will likely increase sharply over the next five to 10 years.

In the run-up to the Friday event, as if in anticipation of the capital deluge, overseas asset managers had been rolling up their sleeves to build positions in the A-share market.

As at the end of March, they held A shares worth about 1.2 trillion yuan, or 3.6 times the value of their holding as of March 2014, according to data from the Chinese central bank. The proportion of foreign ownership in the mainland stock market has risen to 2.5 percent from 1.6 percent in March 2014.

Investment bank China International Capital Corporation or CICC expects that foreign ownership of A shares could increase to 10 percent of the total market capitalization by 2027.

Similarly, the renminbi-denominated bonds issued by the Chinese government and State-owned policy banks were also recently included in the Bloomberg Barclays Global Aggregate Index, the most widely used fixed-income index, which consists of more than 9,000 bonds worth $20 trillion.

Morgan Stanley economists estimated that if Chinese bonds are included in other major global fixed-income indices such as the Citi World Government Bond Index and the JPMorgan Emerging Markets Bond Index in the next two to three years, it could bring $250 billion to $300 billion into the Chinese bond market.

The rising presence of Chinese securities in global markets underscored the growing interest of international investors who are eager to tap into the growth opportunities in China and are encouraged by the improved transparency, liquidity and accessibility of the Chinese markets, market insiders said.

"It's increasingly a consensus that a group of domestically listed Chinese companies will emerge as global leading franchises in their respective industries. However, these investment opportunities were previously not available to overseas investors at all," Li of EFG Asset Management said. He manages a global equity fund and a US equity fund whose total assets are valued at more than $1 billion.

"In the long term, more Chinese companies will be included in global investment benchmarks such as MSCI indices which will further drive the need for global investors to allocate more capital to the Chinese equity market," he said.

Chinese policymakers and financial regulators are pushing to further liberalize the onshore markets.

The Chinese central bank has boosted the daily trading quota by four times under the Stock Connect programs between Hong Kong and the mainland stock exchanges in Shanghai and Shenzhen.

China and the United Kingdom are also preparing to launch a trading link between Shanghai and London this year, which will allow investors in each country to trade shares listed on the other's stock exchange.

"The recent new initiatives from the Chinese government to further open up the Chinese capital market are extremely encouraging for global investors, particularly when the global financial markets are clouded at the moment by the risk of the globalization trend reversing," said Li of EFG Asset Management.

Agreed Bokobza of Societe Generale. "With freedom for mainland investors to trade offshore and foreign investors to buy mainland shares, principally thanks to the 'connect scheme' in Hong Kong, and soon perhaps via the UK, Chinese shares are extraordinarily liquid."

Traded volume as a percent-age of market capitalization is 20 percent in China, and only 8 percent in the US, he said.

"China A shares offer an incredible mix of leverage to the country's domestic economy. That's why, we want to buy them for the next decade. More so because we expect China's stocks to stay neutral, largely unaffected, when the next US market crisis occurs. For example, the Shenzhen Composite Index has among the lowest correlations of all major global indices to the S&P500 index at just 8 percent."

The expected foreign capital inflows will likely help deepen as well as stabilize the Chinese capital market, besides fostering a mature and rational investment style among retail investors who have been shortsighted so far.

"The A-share inclusion in the MSCI EM Index will also expand the usage of the renminbi and enrich the market of financial derivative products related to Chinese securities," said Wei Zhen, director of China research at MSCI Inc.

But the greater presence of Chinese securities in the global financial system will also mean more challenges for international money managers, which will prompt them to review and refine their investment strategies, Wei said.

"There will be a demand for long-term experience and capability of trading the A shares and managing the risks associated with them. Many international institutional investors lack such capability," he said.

As for the Chinese bond market, challenges for foreign investors could be how to reconcile or reclassify onshore ratings in a global index, and the limited liquidity and weak disclosure standards, which hinders fair market pricing and efficient secondary trading, said Nino Siu, a senior analyst at Moody's Investors Service.

But the Chinese government has already moved to reform and improve pricing and secondary market liquidity of government and policy bank bonds, which used to be a major hurdle for international investors.

Measures such as opening access to the foreign exchange derivatives market for foreign investors to hedge their bond positions, and tighter corporate bond collateralization rules are aimed at controlling systemic risks while pushing onshore market practices and standards closer to global standards, Siu said.

The opening up of the Chinese capital markets is not just a one-way street. The country's foreign exchange regulator is also mulling an increase in outbound investment quota for qualified domestic institutional investors. It may also approve a new trading quota for foreign funds that raise onshore money to invest in overseas markets.