China takes a positive step in allowing S&P to rate debt

It’s a step in the right direction, a firm, confident foot forward almost certain to be followed by others.

Chinese regulators have approved a request by S&P Global to enter the debt-rating business to attract more foreign investment to the country, setting up major challenges for the bond-rating agency and the People’s Bank of China.

The decision to allow S&P to rate debt may start a steady march to more accurate pricing in China’s bond market and plays out against the resumption of trade talks Wednesday in Washington. In addition to opening the market, the action may be intended to show Washington that Beijing is serious about reaching a trade agreement.

There will be no immediate miracles or major disruption in China’s debt market. Initially, S&P said it plans to use a system to rate bonds from businesses and local governments tailored to “fit the local situation”, The Wall Street Journal reported, citing a company memo.

The action is clearly incremental. Will it be sufficient to overcome what some outside observers see as bad practices embedded in the market? The short answer: We’ll see if capital is allocated efficiently to spark future growth.

S&P’s credit-rating service in China will be operated independently from the rest of the company, and it’s almost certain to face competition in the future.

Fitch Ratings and Moody’s Investors Service have established wholly owned subsidiaries in China with what looks like plans to follow S&P Global into China’s $11 trillion interbank market. If robust, the competition among ratings agencies will generate more information benefiting investors.

Prior to S&P’s entry into the market, ratings agencies were required to partner with local companies to rate Chinese debt offerings. China’s bond market in 2017 became more accessible to foreign investors through a financial link between Hong Kong and the mainland.

“We believe S&P’s new credit-rating service in China could provide additional confidence to foreign fixed-income investors looking to increase their allocation to onshore Chinese bonds, which are generally underrepresented in most investors’ portfolios,” said Fran Rodilosso, head of fixed-income portfolio management with VanEck in New York.

“We’d also like to see the entrance of other foreign rating firms, and for local rating scales and methodologies to evolve into a system more comparable to international bond ratings. Both could provide additional confidence to offshore investors. More generally, this is another small, but positive, step in the gradual opening of China’s onshore markets, which we believe may provide multiple opportunities for foreign investors.”

“The immediate impact is likely to be small,” said Mathias Kronlund, an assistant professor of finance at the University of Illinois at Urbana-Champaign. “In the longer run, S&P’s impact will mostly depend on how much debt they rate, which in turn depends on how many issuers choose to pay for their ratings.

“For investors, the impact will also depend on whether S&P’s rating scale can distinguish sufficiently between safer and riskier debt. I don’t see a big reason for investors to wait for the other major agencies; the big three agencies tend to give most bonds similar ratings, so having one rating is almost as good as having two.”

Manu George, a fund manager at Schroders in London, called the action a “big deal”.

“It will bring international standards to the rating process of domestic bonds and will encourage foreign investors to look into Chinese corporates in a more serious fashion,” George told the Financial Times. “In the longer term, it potentially opens up onshore Chinese corporates to index inclusion.”

But Paul McNamara, an investment director at GAM in London, called the government’s decision “another marginal improvement” for prospective bond buyers. He said including Chinese bonds in indexes would be “the Holy Grail”.

“With accelerating internationalization of China’s financial market, the introduction of international credit rating agencies will help meet the demand of global investors for diverse yuan asset allocation, provide the quality of credit ratings in China, and play a positive role in promoting the regulated and healthy development of the Chinese financial market,” the People’s Bank of China said in a statement.

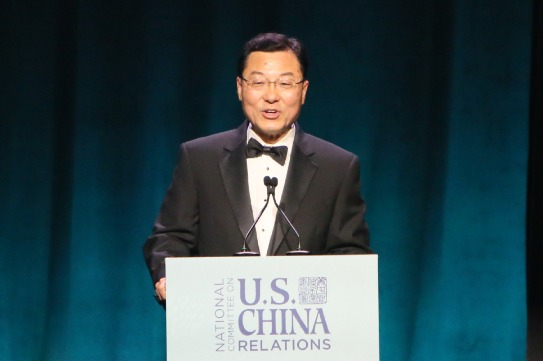

John Berisford, president of S&P Global Ratings, hailed the agreement that allowed his company to be the first foreign-owned enterprise to rate China’s domestic bonds.

He called the approval the latest step in an “ongoing, thoughtful” dialogue with China’s regulators about how they see their financial market”.

“We believe that we are best equipped to provide an independent opinion on China’s debt markets as they develop, and we are ready to play our part.”

Contact the writer at scottreeves@chinadailyusa.com