Five key areas that the central bank will focus on to further push reforms

During the 13th Five-Year Plan period (2016-20), the People's Bank of China, the central bank, had concentrated on serving the real economy, preventing and controlling financial risks, and deepening financial reforms.

During that period, China's financial industry had further strengthened, steadily improving its ability to promote economic and social development.

In the 14th Five-Year Plan period (2021-25), there are five key areas that the PBOC will focus on to push forward financial reforms.

Financial adjustment

We will strive to improve the system of modern central banking, which requires improvements to the central bank's long-term mechanism for adjusting liquidity, capital and interest rate constraints, and ensuring the growth rates of money supply and total social financing match the nominal GDP growth rates.

The central bank will strengthen the rules and transparency of monetary policy operations, through the establishment of an institutionalized Monetary policy communication mechanism, and by effectively managing and guiding expectations.

The central bank's interest rate system will adopt the open market operations' interest rates as the short-term policy rates and will make the medium-term lending facility or MLF rates as the medium-term policy rates.

Based on that, the so-called interest rate corridor mechanism will be improved, guiding the market interest rates to fluctuate around the central bank's policy rates.

The loan prime rate or LPR, a new benchmark of the lending rate, will deepen its reform, which will drive the deposit rate to gradually become market-oriented, so that the central bank's policy rates can be smoothly transmitted to both the lending and deposit rates through changes in the market interest rates.

Reforms require strengthening of the coordination of macroeconomic policies, especially for monetary and fiscal policies, to effectively serve the macroeconomic development.

That needs to strengthen the overall coordination of monetary policy and employment, and the industrial, investment, consumption, environmental protection, and regional policy fields.

The central bank will firmly implement an independent financial budget management system to prevent the monetization of fiscal deficits, and build a "firewall" between the fund sources in terms of the fiscal financing and the central banking.

Institutional system

In accordance with the principles of market forces, rule of law, and internationalization, a modern system of financial institutions is highly adaptable, competitive, and inclusive. It is necessary to strengthen corporate governance as the core, deepen the reforms of State-owned commercial banks, and better serve small, medium and micro enterprises in the private sector.

Starting from the improvement of the system, the reform will support the sustained and healthy development of small and medium banks and rural credit cooperatives, and form a banking system structure with fair competition among all types of banks.

We will strive to reform and optimize policy finance, to separate the account management for policy and commercial businesses, and enhance the ability to support national strategies. We will also improve the financing structure, to develop the bond market and a multi-level capital market, and increase the proportion of direct financing.

During the 14th Five-Year Plan period, we will make overall plans for financial infrastructure development, including comprehensive statistics in the financial industry, anti-money laundering, and financial market registration and custody, clearing and settlement, payment, and credit information service.

Measures will also promote the interconnection of various types of financial infrastructure at home and abroad, and build a financial infrastructure management system that adapts to the two-way financial opening-up.

Financial services, real economy

The first part is to persist in innovative development and improve the system of financial supports through innovations. China will accelerate the formation of a system of venture capital institutions with distinctive features, full of vitality, market-oriented operation, and professional management.

Meanwhile, the sources of venture capital funds will be expanded through multiple channels.

Various functions of the multi-level capital market should be leveraged, including the main board, the science and technology innovation board, the small and medium-sized enterprise board, the growth enterprise board and the national small and medium-sized enterprise share transfer system, and unblock the market-oriented exit channels for venture capital.

We need to encourage financial institutions to increase medium and long-term financing in key areas, such as modern service industries and manufacturing. The implicit lower limit of loan interest rates will be removed, guiding financial resources to small, micro and private enterprises, while improving their competitiveness in the credit market and solving their financing difficulties.

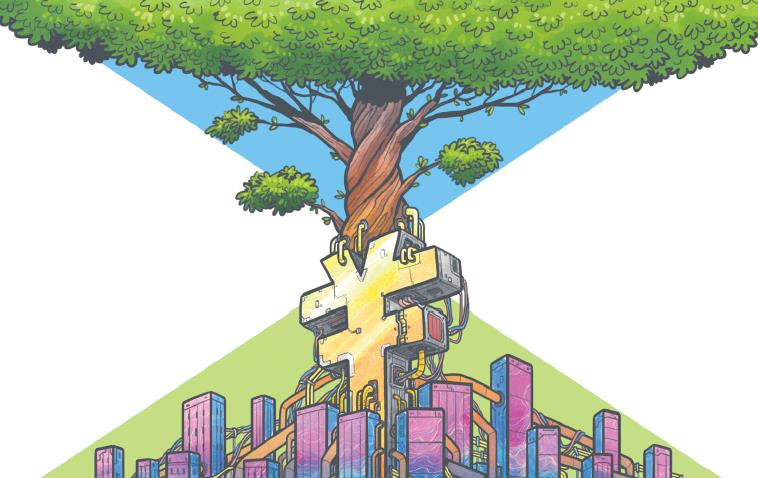

China will build a green financial system that supports the green and low-carbon development of the economy, which will actively support carbon peaking before 2030 and carbon neutrality before 2060, and guide and leverage more financial resources to enter the field.

It aims to make full use of the market mechanisms and improve government incentives, to build a multi-level and diversified green financial market system, and promote market-based trading of carbon emission rights.

New system for higher-level opening-up

The country will continue to implement measures of financial opening-up announced in recent years, ensure that all policies are effectively implemented, and attract more foreign-funded financial institutions to enter the China market.

It is necessary to promote the full implementation of the "pre-access national treatment plus negative list system", set uniform access standards, and promote systematic and institutional opening-up.

We will promote the opening of the financial services industry, the reform of the renminbi exchange rate mechanism, and the internationalization of the RMB.

In terms of the RMB internationalization, we adhere to the principles of market-driven and independent choices of enterprises, which will create a new type of mutually beneficial cooperation based on the free use of the RMB.

It requires us to maintain the flexibility of the RMB exchange rate, give full play to the function of the automatic macroeconomic stabilizer, and achieve a balance between internal equilibrium and external equilibrium.

China will actively participate in the reform of the global economic governance system, strengthen coordination and cooperation with international financial institutions and major economies through multilateral, bilateral, and regional channels.

We will establish and improve the "Belt and Road" financial cooperation network, and deeply participate in the improvement and formulation of international economic and financial rules, and promote the reform of global economic and financial governance mechanisms.

In addition, it is necessary to coordinate development and security, and build a financial safety net in broader means under the opening-up conditions. That also means we need to build various types of "firewalls" to improve our ability to prevent and resolve major risks, and to adapt the regulatory capabilities to a high level of openness.

Stability, priority of policy

In the framework of China's macroeconomic policy, the goal of monetary policy is to maintain price stability and to promote economic growth. Among the four major goals of macroeconomic adjustments, the central bank also pays great attention to employment and other objectives, especially under the new dual-circulation development paradigm. Asset price is also a key issue.

In the future, whether prices will rise and whether the market will form inflation expectation, I think, would be a question of different opinions.

The COVID-19 epidemic has not ended yet, and the world economic recovery and China's economic development are still facing great uncertainties.

There is a view that inflation will increase, mainly because countries have adopted very loose fiscal and monetary policies, and the stimulus has been very strong.

However, since the Global Financial Crisis of 2008-09, some countries have adopted easing policies for a long time. Whether the recent price trend will reverse or not, I think we still need to observe the developing situation closely, given that there is a lot of uncertainty in almost every field.

Loose fiscal and monetary policies will not necessarily lead to higher prices. Studies have shown that an important reason for the low level of prices in the eurozone is that loose policies have made it easy for "zombie" companies to obtain low-cost funds, and the inability in letting the excessive production capacity exit the market has resulted in low prices.

In short, there are many factors that could affect prices, and it is not that the implementation of ultra-loose macroeconomic policies will inevitably lead to an increase in prices.

This year, stability is the priority of the central bank's monetary policy. While maintaining market liquidity and effectively supporting the real economy, the central bank will adhere to the steady monetary policy and maintain the space of using conventional monetary policy as much as possible.

We will pay close attention to changes in macroeconomic indicators, with price change as one of the most important indicators, and implement the monetary policy well.

This comment is part of Wang Xin's speech delivered at a meeting by China Finance 40 Forum. Wang is head of the Research Bureau of the People's Bank of China, the central bank, and a special invitee to the CF40.

The views don't necessarily reflect those of China Daily.