More global forex turmoil ahead

As if the world economy would need another crisis trigger, global foreign exchange markets are in historical turmoil. Over time, it can't be contained without a more diversified global reserve currency system.

According to Bloomberg, global foreign currency reserves have fallen some 7.8% to $12 trillion this year; a decline of $1 trillion, or more than in almost two decades, when Bloomberg began to compile its data.

The plunge reflects the frantic activity of central banks across the world as they struggle to intervene and support ailing currencies. In late September, the euro coped with its 20-year low against the US dollar.

Meanwhile, the British pound suffered its all-time low vis-à-vis the greenback. Recently, the pound has recovered some of the lost ground, as has the euro. But new pressures will ensue as the Fed will continue its tightening.

In September, Japan spent some $20 billion to slow the yen's slide in its first intervention to boost the currency since 1998. That's 19% of the loss of reserves this year. Still, the yen has already lost a fifth of its value this year, which could prove its worst since 1970. Meanwhile, Japan's gross debt as percentage of the GDP could soar close to 270% by the year-end; the highest among major advanced economies – and most vulnerable to a crisis that would have global repercussions.

Emerging Asia has not been immune to these pressures.

Korea's plunge, India's all-time low, China's dual story

In September, Korean foreign reserves amounted to $417 billion, having taken a $20 billion hit from the previous month. That's the fastest on-month decline since the West's financial crisis in October 2008.

In India, forex reserves have tumbled $96 billion this year to $538 billion. The pressures are accelerating as inflation is rising and the Fed's hikes continue.

While currency depreciation can benefit exporters, it tends to foster capital flight and imported inflation, both of which are spreading in emerging Asia. Hence, too, the plunge of India's forex reserves by $110 billion in the last 13 months and the rupee's all-time low against the greenback.

At the end of September, Reuters reported that Chinese state-owned banks are preparing to sell dollars and buy yuan to boost the local currency. The yuan has fallen 11% against the dollar and could finish the year with its biggest decline against the greenback since 1994.

Yet, the dollar pressures tell only a part of the story. China's central bank is increasingly managing the yuan against the currencies of a broad group of major trading partners, not just against the greenback. Despite its decline vis-à-vis the dollar, the yuan has appreciated against the euro, the yen and other major currencies.

Today, forex volatility is not a mainly economic issue. It also reflects geopolitical objectives.

Huge forex interventions

As the world economy is teetering at the edge of still another global recession, the Fed's belated and aggressive tightening is causing huge monetary shocks in the world economy.

While the magnitude of the decline of global forex reserves is massive, the efforts to exploit reserves to protect currencies are nothing new. Nevertheless, these huge forex interventions take place in the most challenging economic and geopolitical moment since World War II, due to a series of shocks:

-the failure of global recovery since 2017, as a result of US protectionism and misguided trade wars

-the subsequent Covid-19 pandemic and the accompanying global depression and the consequent lost years in many countries

-over a decade of huge fiscal stimulus packages, ultra-low rates and rounds of quantitative easing in the West

-the ensuing debt crises in many middle- and low-income countries

-the US-led NATO war against Russia in Ukraine, which has led to global energy and food shocks and the worst nuclear crisis since 1962

If the Fed sticks to its "dot plot," interest rates could reach 4.4% by December, above 3.4% projected in June, and rise to 4.6% next year. As a result, the peso could slide to an all-time low of about 62 against the US dollar later in the year. Just as the global forex turmoil could prevail until the first quarter of 2023.

Even if the buoyant dollar will make the US a more expensive place to produce, it will affect America less severely than its trading partners, mainly because US trade is almost entirely invoiced in dollars.

But what will happen when the dollar's surge against other major currencies will eclipse? Some previous big run-ups in the dollar's value, particularly in the mid-1980s and early 2000s, were eventually followed by sharp declines. And this time could prove worse.

A rising dollar is neither stabilizing nor strong

After two decades of postwar recovery in Western Europe and Japan, US began to suffer from huge trade deficits. In 1971, President Nixon ended unilaterally the convertibility of the dollar to gold, which resulted in a price shock that reverberated across the world.

As gold no longer offered a yardstick for value, the perception of value replaced value itself.

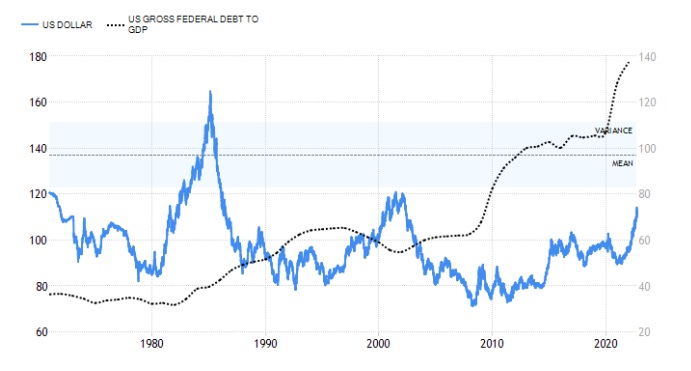

Since the 1970s, three periods of dollar surges have been followed by periods of decline that have caused much international collateral damage. Each of these surges reflects progressive relative erosion of the dollar. When the dollar surged with sky-high rates in the early 1980s, US sovereign debt was still less than 40% of America's GDP. With the surge in the early 2000s, the ratio was hovering around 55%. That prevailed until the 2008 crisis, which was overcome with massive debt-taking that pushed the ratio beyond 100% in the early 2010s.

Then came the pandemic and the Biden administration's irresponsible fiscal policies and now the ratio exceeds 137% of US GDP (more than twice as high than the Philippines' 62%). As the trendline will accelerate in the coming years, the ratio could double by 2050 (Figure).

Toward the crisis

Today, US debt per GDP is where that of Italy was in the early 2010s, right before Rome's debt crisis. Here's the problem: The Italian lira is irrelevant in international transactions, but US dollar isn't.

The presumed strength of the US dollar no longer relies on America's economic fundamentals, but on a perception that such fundamentals prevail, despite drastic shifts in the world economy.

US dollar is no longer a sustained safe haven, but a temporary safe house. And that's why the day of reckoning is no longer a matter of principle, just a matter of time.

Dr. Dan Steinbock is an internationally recognized strategist of the multipolar world and the founder of Difference Group. He has served at India, China and America Institute (US), Shanghai Institutes for International Studies (China) and the EU Center (Singapore). Based on Dr Steinbock's global briefing of Oct 7, 2022. The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.