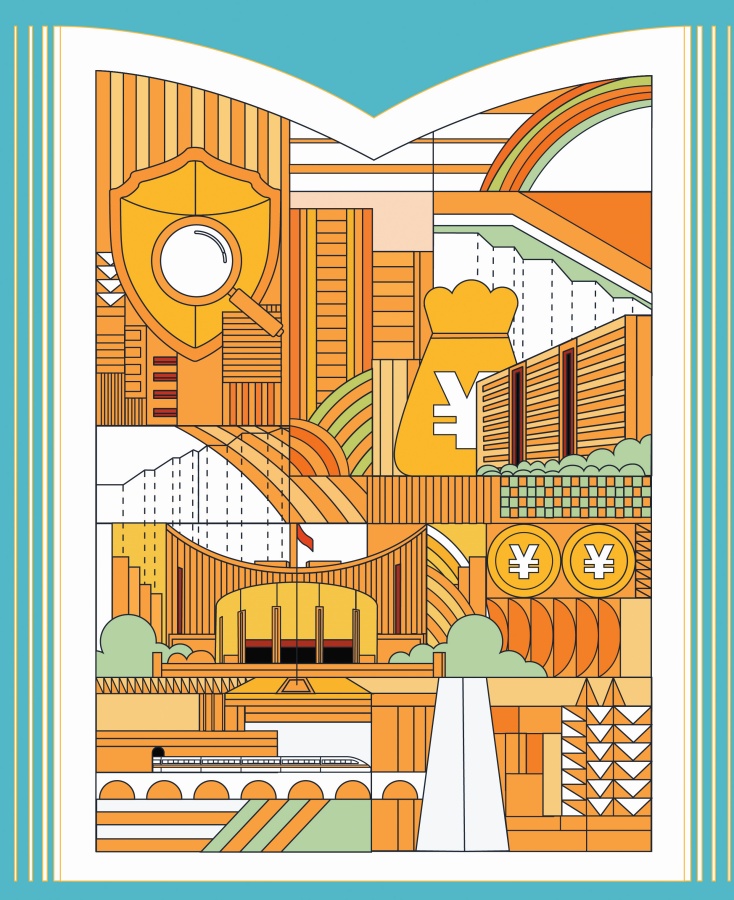

Stimulus aims to bolster economy

Recently introduced package of measures expected to shore up market sentiment at home and abroad

China has recently rolled out a powerful combination of monetary easing measures as part of efforts to bolster market sentiment and support economic recovery amid domestic downward pressure and mounting global headwinds.

The policy package, which includes trimming the reserve requirement ratio, key policy interest rates and existing mortgage loan interest rates, is seen as a potent one-two punch to foster a more conducive environment for the world's second-largest economy to achieve its annual growth target, according to analysts.

The latest macroeconomic data, which indicates a relatively soft rebound in consumption and tame inflationary dynamics, have provided policymakers with greater flexibility to roll out more targeted measures to stimulate economic activity, said Ming Ming, chief economist at CITIC Securities.

The People's Bank of China, the country's central bank, announced in late September the lowering of the reserve requirement ratio — the amount of cash that banks are required to have on hand — for financial institutions by 0.5 percentage points, except those that have already implemented a 5 percent reserve ratio.

This latest RRR reduction, coming after a similar 0.5 percentage point cut in February, is expected to provide the market with approximately 1 trillion yuan ($141 billion) for new lending. Following this reduction, the weighted average RRR for financial institutions is expected to be around 6.6 percent.

This level still leaves room for further reduction when compared to the policies of major central banks around the world. China will not shy away from further RRR cuts of 0.25 to 0.5 percentage points this year, should the situation call for it, said Pan Gongsheng, governor of the PBOC, hinting at the possibility of a third RRR cut within 2024.

Given that financial institutions that were previously subject to a 5 percent RRR have not been included in the latest 0.5 percentage point reduction, the current lower limit for the RRR stands at 5 percent, leaving approximately 1.6 percentage points of additional room for potential cuts, according to experts.

They suggest that if the PBOC chooses to implement RRR reductions in increments of 0.5 percentage points, the central bank could potentially carry out another three to four such cuts.

Wang Qing, chief macroeconomic analyst at Golden Credit Rating International, said that the RRR cut will enable banks to allocate more funds toward the purchase of government bonds, which are currently at their issuance peak.

Data from financial information provider Wind showed that local government special bonds reached a monthly issuance of around 1.03 trillion yuan in September, setting a new high within the year.

The funds raised from these government bond sales will be used to expand investment and promote consumption, with a current focus on supporting large-scale equipment upgrades and the replacement of durable consumer goods, Wang said.

In the first eight months of this year, China's investment in equipment and tool purchases had increased by 16.8 percent year-on-year — well above the 3.4 percent increase in total fixed-asset investment, according to data from the National Development and Reform Commission.

Retail sales of passenger vehicles in August rose by 10.8 percent compared with the previous month, while new energy vehicle sales increased by 17 percent month-on-month in August. Sales of home appliances and audio and video products returned to growth last month, up 3.4 percent year-on-year.

At the same time, the RRR cut will provide banks with more lendable funds, enabling them to step up their credit support for businesses and households, Wang said.

Banks will ramp up their credit extension efforts in the coming months, which will help reverse the substantial year-on-year slowdown in new yuan-denominated loans observed in the first eight months of the year — a crucial measure to reinvigorate the growth momentum of the economy, Wang added.

The central bank also announced a 0.2-percentage-point reduction in its seven-day reverse repo rate, the short-term policy benchmark, from the current 1.7 percent to 1.5 percent, marking the largest single-shot rate cut since 2021.

Pan from the PBOC said this move is expected to drive down the medium-term lending facility rate by around 0.3 of a percentage point, with the loan prime rates and deposit rates also projected to follow suit, declining by 0.2 to 0.25 of a percentage point.

The synchronized decline in deposit rates and the LPR will help commercial banks preserve their net interest margins, which are crucial for sustaining their financial health and lending capacity. By maintaining the stability of bank margins, the central bank is creating an environment that enables lenders to continue supporting the real economy with affordable credit, experts said.

Wen Bin, chief economist at China Minsheng Bank, said the central bank's actions come at a time when financial data has shown an overall weakness in household and business leverage appetite this year, while inflation readings have remained low.

The interest rate cut will help slash real financing costs, thereby stimulating consumption and investment and improving the overall growth momentum of the economy, Wen said.

Moreover, with the US Federal Reserve also lowering rates, the interest rate gap between China and the US has narrowed. The Chinese yuan has been strengthening overall, which has eased the constraints on the PBOC's ability to pursue more accommodative monetary policy, Wen said.

A new set of policies aimed at further stabilizing the real estate market has also been unveiled, including a 0.5-percentage-point reduction in average existing mortgage rates and lowering the minimum down payment ratio from the current 25 percent to 15 percent on all types of homes.

Experts say the central bank's actions are providing a sense of reassurance to existing mortgage borrowers, which is expected to help the real estate market quickly arrest its decline and avoid any potential spillover effects on consumer spending.

Dong Ximiao, chief researcher at Merchants Union Consumer Finance, said the elevated level of existing mortgage interest rates has triggered a notable wave of early loan repayments, posing a drag on household consumption.

In a report released in July, the central bank stated that the average monthly early repayment volume reached 387 billion yuan from September to December last year, which translated to an annualized early mortgage repayment amount of around 4.6 trillion yuan.

The surge in early mortgage repayments, driven by the high interest rate environment, has had a tangible impact on household consumption. The new policies will provide much-needed support to homeowners, allowing them to redirect funds toward other household expenditures and bolster the overall consumption recovery, Dong added.

To enhance banks' capability to support the real economy, Li Yunze, head of the National Financial Regulatory Administration, said that China plans to increase the tier-1 capital of six major commercial banks.

Tier-1 capital refers to the core capital held in a bank's reserves, including common stock and disclosed reserves.

PBOC governor Pan also outlined new monetary tools to bolster the stock market, including a swap facility for securities, fund and insurance companies, which will allow eligible institutions to obtain liquidity from the central bank by pledging assets.

Additionally, Pan said the PBOC will introduce a relending facility to encourage banks to provide loans to listed companies and major shareholders to support share repurchases and shareholding increases.

wangkeju@chinadaily.com.cn