Swamped with listing choices

Updated: 2007-09-06 06:26

Shanghai, Hong Kong, Singapore, NYSE, NASDAQ, London, Frankfurt the list of suitors for Chinese companies these days is just endless when it comes to picking the right exchange to list.

As the A-share market swings between an ultra-wide band - and analysts are saying the market will continue to be like this next year as well - and overseas exchanges ease their rules to cozy up to new listing candidates, Chinese companies suddenly find themselves swamped with choices.

In the last few months, NYSE has weaned away a few Chinese companies that are believed to have been originally planning to head for NASDAQ. The latest was Qiao Xing Mobile Communications Co Ltd, which controls CEC Telecom Co Ltd (CECT), the fourth-biggest Chinese mobile phone maker. It made its debut on the NYSE on May 3. The company was rumored to have been torn between NASDAQ and Hong Kong Stock Exchange until it fell for NYSE.

These days it's not uncommon for Chinese companies in search of a home for its shares to be approached by representatives of the two exchanges at the same time. And the results are showing. Last year, six Chinese companies listed on NASDAQ and four on NYSE. In just the first five months of this year, 10 companies have listed on NASDAQ and five on NYSE.

As the Chinese government clearly wants its large State-owned enterprises to list at home, the NYSE, the largest bourse in the world, has been chasing smaller - but perhaps more entrepreneurial - Chinese companies. Among the 99 overseas IPOs last year, 86 came from the private sector.

NASDAQ, meanwhile, hasn't been sitting idle either. Going beyond its traditional focus on the technology industry, it's been actively courting companies from increasingly diverse trades, including services, manufacturing, healthcare and media.

On April 3, Bob Greifeld, president and CEO of NASDAQ, flew to Beijing. Soon after landing, he rang a ceremonial bell in downtown Oriental Plaza, announcing the opening of the electronic market for the first time in China, and then went off to release a NASDAQ China Index to track the performance of the 30 largest Chinese companies listed in the United States.

Greifeld was like a man on a mission. And a mission it was, of revenge. Almost on the same day, NASDAQ's rival, the New York Stock Exchange Group, was celebrating its merger with Euronext - thus leading to the creation of the first transatlantic bourse - while NASDAQ failed to acquire the London Stock Exchange (LSE).

"We focus with great intensity on competition with NYSE. We are in the process of taking a part of the floor of the NYSE 'board by board'," Greifeld said in Beijing. He was trying to avenge losing Europe to his rival by securing China.

Regional pulls

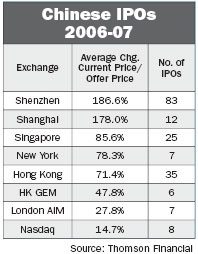

But NYSE and NASDAQ are not the only contenders for Chinese listings. According to statistics from consulting firm Richlink International Capital Co Ltd, 99 mainland companies launched offshore initial public offerings (IPOs) last year, compared with 70 in 2005. The total money raised was $44 billion, an increase of 120 percent from that of 2005.

Hong Kong and Singapore were the most popular destinations for mainland companies. While 43 companies listed in Hong Kong, 24 listed in Singapore last year.

When it comes to attracting large State-owned enterprises (SOEs) to launch offshore IPOs, Hong Kong's pull is unmatched. In 2006, it saw giant IPOs launched by Bank of China and the Industrial and Commercial Bank of China, while Singapore exchange is traditionally stronger in attracting manufacturers.

Apart from Hong Kong and Singapore, LSE's second market, the Alternative Investment Market (AIM), has been scoring big on China since 2005. Pouncing on the opening created by the Sarbanes-Oxley Act five years ago by US regulators in the wake of corporate scandals, this bourse has attracted as many as 16 Chinese companies to list in London in 2006.

"It's because the listing barrier of AIM is comparatively low. And the cost accounts for just 5 to 20 percent of the total money a company raises," says Xue Haibin, a lawyer with Zhonglun W&D Law Firm, to explain the exchange's charm.

Faced with the threat of losing its listing appeal to the likes of AIM, the US Securities and Exchange Commission (SEC) announced on May 23 that it is easing compliance with Sarbanes-Oxley, especially Section 404 of the corporate governance law, which focused too much on cumbersome rules.

"It's possible that the SEC will adopt the International Financial Report Standards rather than the US GAP," Michael Yang, executive director of NYSE Group Asia-Pacific, said at a financial forum in the 10th Beijing Hi-tech Expo on May 26.

Financial Times data shows that in 2006, the total cost of 400 companies to list in the United States reduced by 23 percent from 2005. As the listing cost in the US is expected to go down even more, the war of the bourses for Chinese affections will only get fiercer.

While choosing the exchange to list, valuation is often the primary consideration. But the performances of companies can vary significantly after listing.

Companies such as the well-known New Oriental School and Shenzhen Mindray Bio-Medical Electronics Co Ltd performed well on their debut on the NYSE, with opening trading prices surging respectively 46.7 percent and 22 percent from their IPO prices.

But the share price of another Chinese firm, Xinhua Finance Media, dropped 8 percent minutes after its trading began, closing 11.7 percent lower than its IPO price. In the next two months, the company's market value shrank another 48.38 percent after a series of top officials resigned and lawsuits were launched by angry investors as it came to light that the company's former chief financial officer Shelly Singhal mislead the market ahead of the company's IPO.

Shape up

Listing overseas not only helps Chinese entrepreneurs raise funds, but also gives them many other advantages.

"In the short term, it's raising funds, but in the long term it wins you respect," said Zhang Xiangning, CEO and founder of Tixa Tech Group.

But the growing demand for Chinese companies also means a growing expectation from them in terms of quality and skills to manage their investor relations.

"All companies want a high P/E (price-earnings ratio). But what they often ignore is their post-listing performance," says Vicente Liu, chief representative of Asia Pacific and China Affairs from Cowen & Company, a US-based technology investment bank. "Only with healthy research coverage can investors be confident about the company."

Because of the immaturity of the mainland stock market, many Chinese companies have yet to form the habit of delivering regular financial reports and helping financial analysts monitor their performances.

(China Daily 09/06/2007 page59)

|

|

|

||

|

||

|

|

|

|