Racing for the rich

Hong Kong may be trailing other economies in the global contest for affluent entrepreneurs and businesses, but the Chinese mainland's rapid economic growth and the city's deeper integration within the Greater Bay Area has helped the SAR soften the imbalance in wealth migration, Wang Yuke reports.

Amid worldwide societal, political and financial unease, coupled with disruptions, constant global recalibration and paradigm shifts, vying for the lucratively competent businesses has unfolded in a blatant, if not aggressive, way.

Economies worldwide are dishing out a dazzling suite of "gourmet" policies for wealth immigration and business relocation and continually upgrading their menu. At the end of the day, it's a gold-mining zero-sum game, with those offering the most streamlined policies and lavish benefits, and not setting the bar too high, winning the cream of the crop.

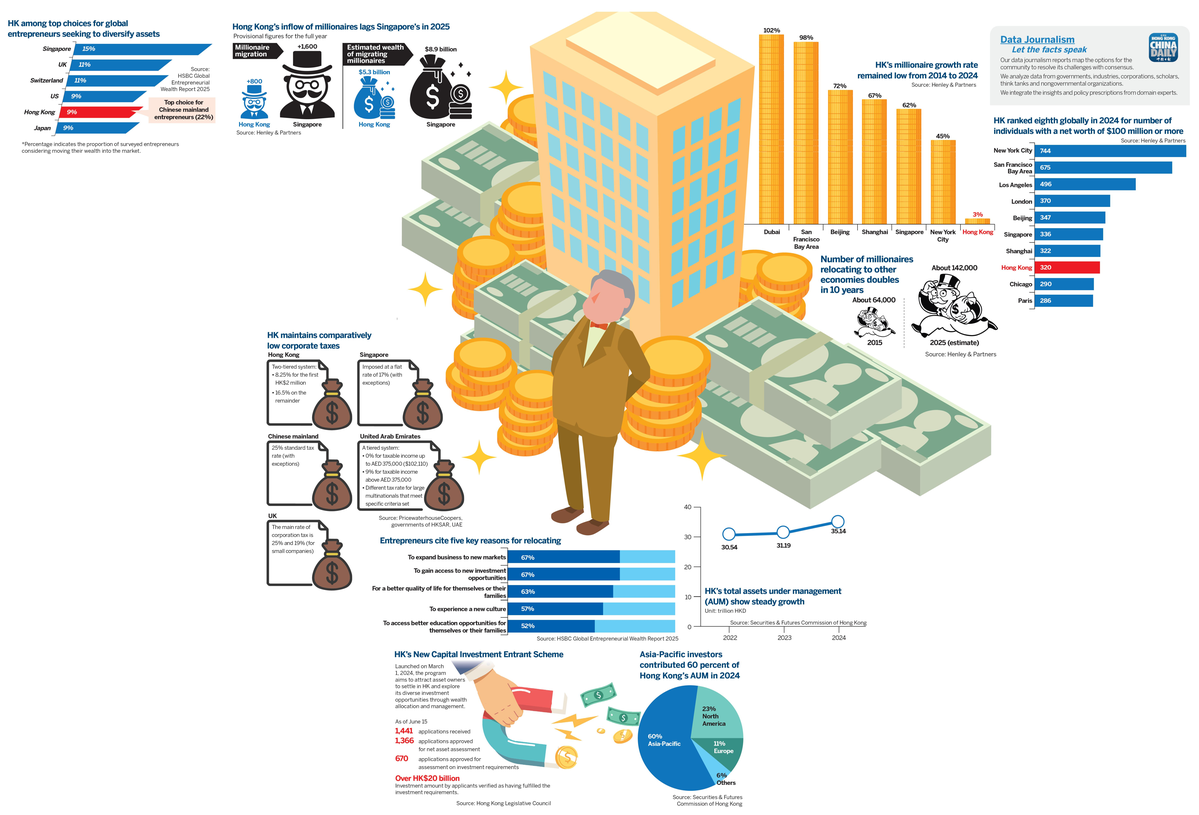

Hong Kong has fared well, thanks to its connections to the West, affinity with the East, efficacious offshore and inshore financial and cultural middle-man's role, and well-entrenched legal and financial systems. According to Henley & Partners' Private Wealth Migration Report 2025, the city is on track to welcome a net inflow of more than 800 high-net-worth individuals (HNWIs) this year, ranking 11th worldwide.

The special administrative region is in a nuanced spot in the race for rich, elite entrepreneurs as a magnet for established and emerging wealth, with remarkable cash inflows from across Asia, yet pitted against full-fledged economies like Singapore and the United Arab Emirates, and tested by the rising prominence of other Asian cities. While the SAR's challenges have yet to be fully erased, its proximity to the Chinese mainland and integration into the Guangdong-Hong Kong-Macao Greater Bay Area allow innovative economies to seep into the culture, policy, economy and population.

What is driving the move?

Immigration and relocation are weighty life decisions as they allow little room for "recalling". The overriding factors driving relocation choices vary, primarily hinging on the quality of life, political and economic stability, tax efficiency, access to global markets, ease of doing business, and freedom of movement, says Denise Ng, managing partner and head of North Asia at Henley & Partners — a leading globally-integrated residence and citizenship advisory firm.

Equally decisive factors cover access to premium education, quality healthcare and the availability of residence and citizenship programs. In many cases, HNWIs and entrepreneurs see relocation or immigration as a "strategic diversification move" to safeguard their assets, and ensure lifestyle continuity and global mobility. "Jurisdictions offering transparent regulations, low taxes and geopolitical stability are viewed as long-term enablers of wealth preservation and business expansion," says Ng.

It doesn't take a stretch of imagination to recognize why jurisdictions offering tempting residency-by-investment incentives, often referred to as "golden visa programs", are highly coveted. Such offers allow HNWIs to diversify and hedge their assets, while granting them the right to reside, work and access education and healthcare in their choice destinations.

Among more than 100 economies that offer residency-by-investment pathways, six stand out in Asia — Hong Kong, Singapore, Malaysia, Thailand, Japan and Kazakhstan. Hong Kong has proven to be a high achiever globally by excelling in key areas like tax structure, investment requirements, processing efficiency and overall costs, according to the 2025 index published by Henley &Partners.

However, the HKSAR trails in the grueling stretch to citizenship and the overall quality of life, while Singapore has emerged as the clear leader. Compared with Hong Kong's uninterrupted seven-year requirement for securing permanent residency, the Lion City's equivalent threshold is just two years or slightly longer. The pathway remains comparatively generous although foreign applicants must renounce their own citizenships to become naturalized Singaporeans.

So far this year, Hong Kong has welcomed only 800 new millionaires, who added $5.3 billion to the city's wealth. This influx pales in comparison to other countries, with the UAE attracting 9,800 millionaires, the United States 7,500, Italy 3,600, Saudi Arabia 2,400, and Singapore 1,600, according to Henley & Partners.

Beyond the numbers

Hong Kong seems to have been overshadowed by other sought-after migration destinations — having hit a bottleneck in attracting and expanding wealth, a perception often attributed to the scars left by past social unrest and a prolonged post-pandemic economic rebound. However, experts argue that the numbers alone are misleading if taken at face value as they mask Hong Kong's subtle, yet defining upward shifts in its wealth landscape.

The SAR's evolving wealth demographics reflect "relative shifts", rather than a decline, says Parag Khanna, CEO of AlphaGeo, an artificial intelligence-based geospatial predictive analytics platform, and an authority on migration, globalization and future trends."It's really about relative gains," he explains.

The mainland's rapid economic expansion, innovative industries and massive economies of scale are generating unprecedented new wealth, naturally increasing the number of wealthy mainland individuals relocating to Hong Kong. Studies reveal that a significant share of Hong Kong's new wealth inflows comes from top-earning executives of Shenzhen's high-tech corporations, according to Henley & Partners.

A Deloitte study commissioned by InvestHK — the HKSAR government's investment promotion arm — estimates that the city hosted more than 2,700 single-family offices by late 2023, many backed by deep-pocketed mainland families.

Along with capital, talent inflows have surged, with 75 percent of 270,000 work visas issued by Hong Kong's Immigration Department in the 2023–24 financial year having gone to skilled mainland professionals.

A shift, not a decline

Has Hong Kong sidelined overseas entrepreneurs and affluent individuals, risking an imbalance in wealth demographics and cultural diversity?

Khanna firmly rejects such an interpretation, calling the phenomenon a recalibration, not a contraction, of wealth. "It's not that Hong Kong is losing foreign wealthy people," he says. "It's simply that the mainland is generating so much wealth, and with Hong Kong's deeper integration into the nation and the inflow of mainland HNWIs, it's only natural that their numbers in Hong Kong would grow organically."

Ultimately, he stresses, this is a relative shift. "It's absolutely positive to see more wealthy people overall. It matters less where they come from."

Despite some voices forecasting that fastrising mainland cities, such as Guangzhou, Shenzhen and Hangzhou, may be pitted against Hong Kong in the competition for Asian millionaires and entrepreneurs, Khanna argues that the comparison is misplaced on many fronts. His bottom line — a rising tide lifts all boats.

Hong Kong is deeply embedded in the country's broader development and strategic positioning in the global competition for mobile capital. The "new wealth generation" emerging on the mainland will inevitably produce more "mature and established rich", he says, while "individuals will choose to move to Hong Kong once they've become very wealthy, typically for two reasons — privileged access to the mainland market or government-backed opportunities in growth sectors like financial technology and cryptocurrencies".

According to Henley & Partners, Hong Kong's millionaire population growth languished at just 3 percent from 2014 to 2024 — one of the weakest showings among the world's top 50 millionaire cities. This contrasts sharply with 62 percent in Singapore, 72 percent in Beijing and 67 percent in Shanghai.

Warning against seeing these numbers as stagnation, Khanna says: "Hong Kong has been at the top and remains in the top tier. That's what matters." For ultra-rich density, the SAR has consistently ranked among the world's leading cities, but these rankings among global wealth hubs aren't materially meaningful, he says. "Whether you're number one or number seven, it doesn't really matter. If my city has 350 billionaires and yours has 250, the difference is negligible."

What's changing, says Khanna, is geography. Asia is rising and Hong Kong is "becoming more Asian, more connected and more integral" to regional financial networks. He describes Hong Kong's transformation as the"Asianization" of its financial identity. "You can see Hong Kong reaching out to Tokyo, Singapore, Sydney, New Delhi in finding new ways to be part of a larger Asian financial system," he says. Such a shift benefits Hong Kong and the mainland as capital flows become increasingly regional on top of being international.

Complementary financial hubs

Ng says Hong Kong's position fits squarely within broader wealth-migration patterns in Asia. She points to recent analysis showing that ultra-high-net-worth families, especially from China and India, are increasingly adopting a dual-hub strategy, operating between the HKSAR and Singapore to balance opportunities and risks.

This trend underscores the complementary strengths of the two financial centers, says Ng. HK's appeal lies in its proximity to the mainland's $18.8-trillion economy, the city's deep and liquid capital markets and its strong connectivity across North Asia, while the SAR's flexible family-office tax concessions allow qualifying offices to self-declare after a year of operations, giving long-term investors greater structural ease, she says.

Hong Kong also continues to exhibit robust capital-market activity as one of the world's top four initial public offering venues last year, raising HK$83 billion ($10.7 billion)with 66 listings, reflecting the city's role as a major platform for IPOs in the region, says Ng.

Strategic advantages and appeal

Magdalene Tennant, managing director, and Kitty Lo, director, of Fragomen — a global firm specializing in immigration services — note that Hong Kong continues to attract HNWIs seeking a stable base in Asia with strong connectivity and clear pathways for investment and mobility.

"Hong Kong's position within the Greater Bay Area gives it direct access to one of the region's most dynamic economic clusters, allowing entrepreneurs and investors to tap into fast-growing markets, while maintaining a global base."

They say the SAR distinguishes itself as a highly accessible and business-friendly city — a factor that appeals to many of Fragomen's clients. Compared to Singapore, Indonesia or the Chinese mainland, Hong Kong's consistently straightforward immigration processes, visa-free for businesspeople or tourists of various nationalities, and talent attraction programs that allow people to explore opportunities with minimal barriers are among its selling points.

Fragomen's clients often cite Hong Kong's robust legal system, transparent regulatory environment, simple tax structure and strong banking sector as key reasons for choosing the city, according to Tennant and Lo. The SAR's efficient infrastructure, safety, vibrant cultural atmosphere, and connectivity across Asia and beyond make it an attractive base for both personal and professional life.

Entrepreneurs also regard the SAR as China's primary offshore hub for raising capital."The Closer Economic Partnership Arrangement — a free trade agreement between Hong Kong and the mainland — combined with a broad network of double taxation agreements, provides businesses with clarity and reduced tax burdens. This framework makes Hong Kong a natural base for managing investments across the Greater Bay Area and the wider region."

According to Fragomen, many individuals thinking of moving to Hong Kong are in their late 40s, with a significant number from the mainland and other Asian markets. While some may ultimately decide against relocating, often out of economic or other concerns, their decisions reflect personal circumstances.

Although Hong Kong's high-net-worth population has grown more slowly than in some regional markets, Tennant and Lo emphasize that the city still hosts a "substantial concentration of wealth". Its New Capital Investment Entrant Scheme targets those seeking passive investment opportunities and provides a "clear path to permanent residency". Unlike many other jurisdictions, applicants "do not need to run a business" to qualify for residency. The program covers real-estate investments and eligible property ownership, while the suspension of the buyer's stamp duty and new residential stamp duty for property buyers makes investing even more straightforward.

Taking Hong Kong forward, the SAR government's initiatives have lifted the city's international status, such as developing green and sustainable finance, low-carbon technologies, and expanding its offshore renminbi business.

Tennant and Lo stress that such a combination of stability, strategic location and supportive investment frameworks has positioned Hong Kong well "not just to attract new entrepreneurs, but also to support those already established in the city". Many business owners remain highly mobile, and Hong Kong's backing of innovation, growth and connectivity gives them confidence to "establish, grow and manage their ventures". By maintaining these advantages, Hong Kong continues to be a center for creating wealth and investment in the region.

In Ng's view, Hong Kong still has significant room to improve by strengthening policy flexibility, expanding immigration pathways for entrepreneurs, and bolstering investor confidence through clear and transparent rules.

These steps would not only reinforce the metropolis' footing as a premier business hub, but also ensure it remains a magnet for talent and capital in an increasingly competitive global landscape.

Wang Yuke is a freelance journalist for China Daily.

- Racing for the rich

- Unraveling the cosmic puzzle

- China mulls law revision to protect passenger rights

- China mulls draft revision to law on standard spoken, written Chinese language

- China advances legislation on state assets

- China pushes forward legislative process of draft ecological environment code